Investment Objective

- The investment objective of the Scheme is to achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies following consumption theme.

- There is no assurance that the investment objective of the Scheme will be achieved.

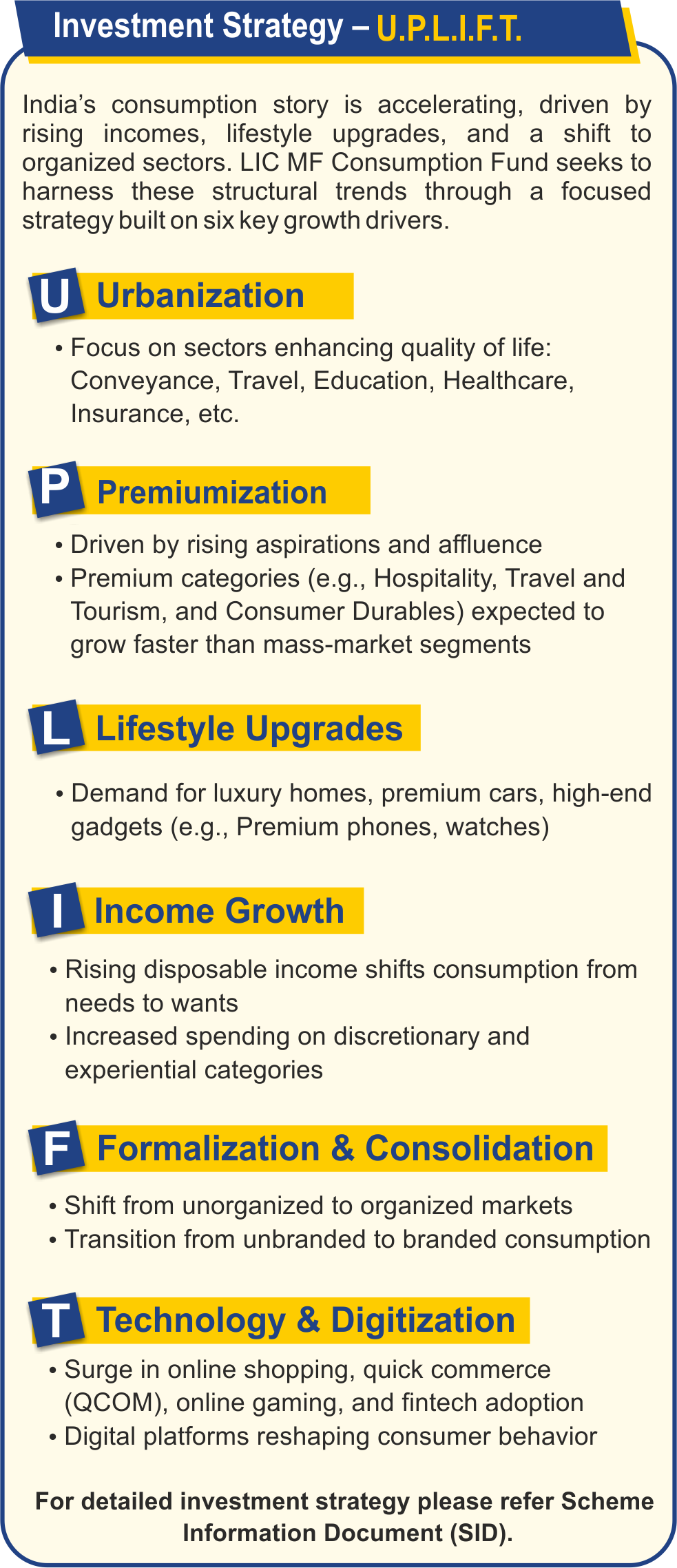

Investment Strategy - U.P.L.I.F.T.

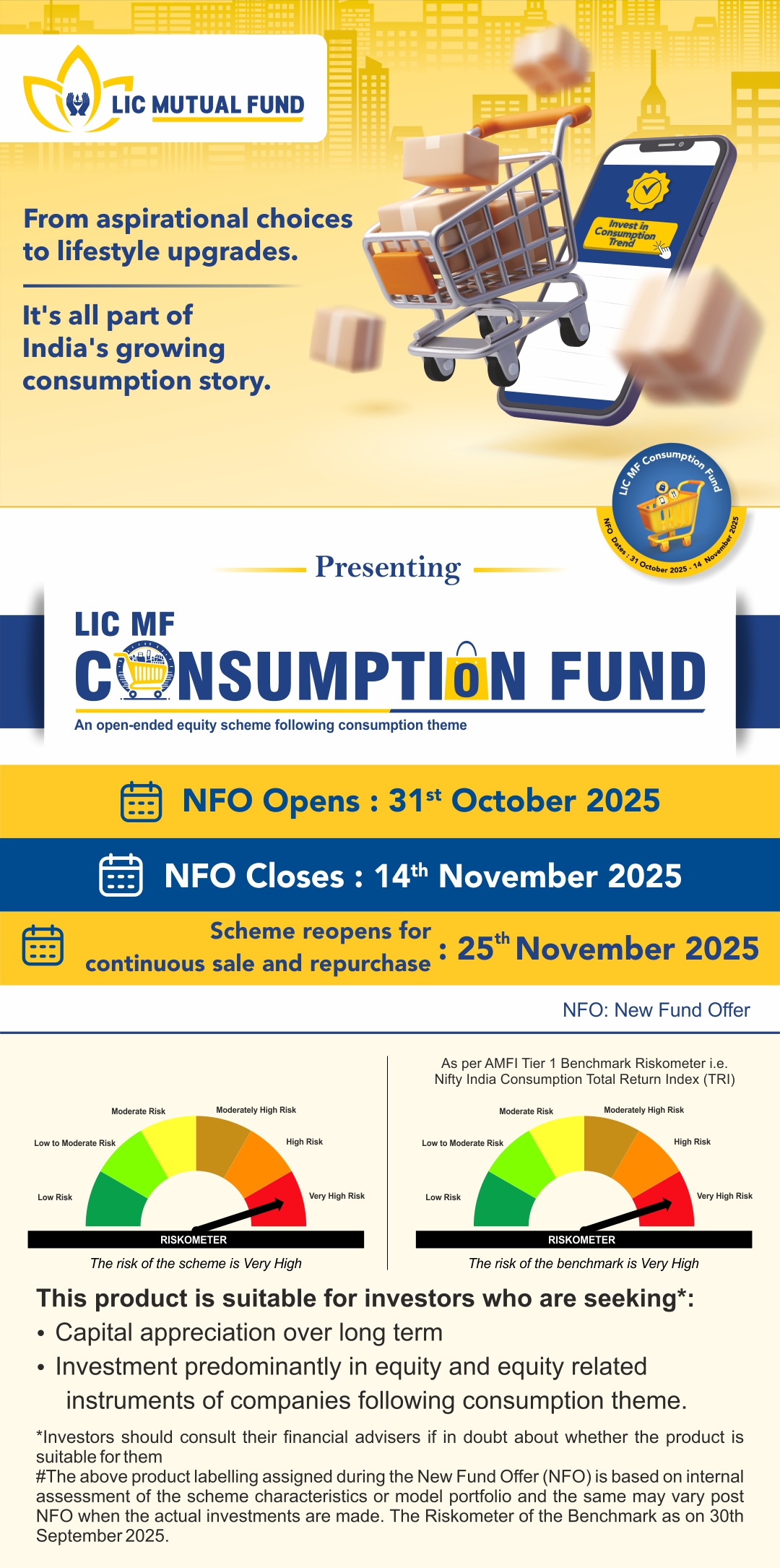

India’s consumption story is accelerating, driven by rising incomes, lifestyle upgrades, and a shift to organized sectors. LIC MF Consumption Fund seeks to harness these structural trends through a focused strategy built on six key growth drivers.

- Focus on sectors enhancing quality of life: Conveyance, Travel, Education, Healthcare, Insurance, etc.

- Rising disposable income shifts consumption from needs to wants

- Increased spending on discretionary and experiential categories

- Driven by rising aspirations and affluence

- Premium categories (e.g., Hospitality, Travel and Tourism, and Consumer Durables) expected to grow faster than mass-market segments

- Shift from unorganized to organized markets

- Transition from unbranded to branded consumption

- Demand for luxury homes, premium cars, high-end gadgets (e.g., Premium phones, watches)

- Surge in online shopping, quick commerce (QCOM), online gaming, and fintech adoption

- Digital platforms reshaping consumer behavior

Why LIC MF Consumption Fund?

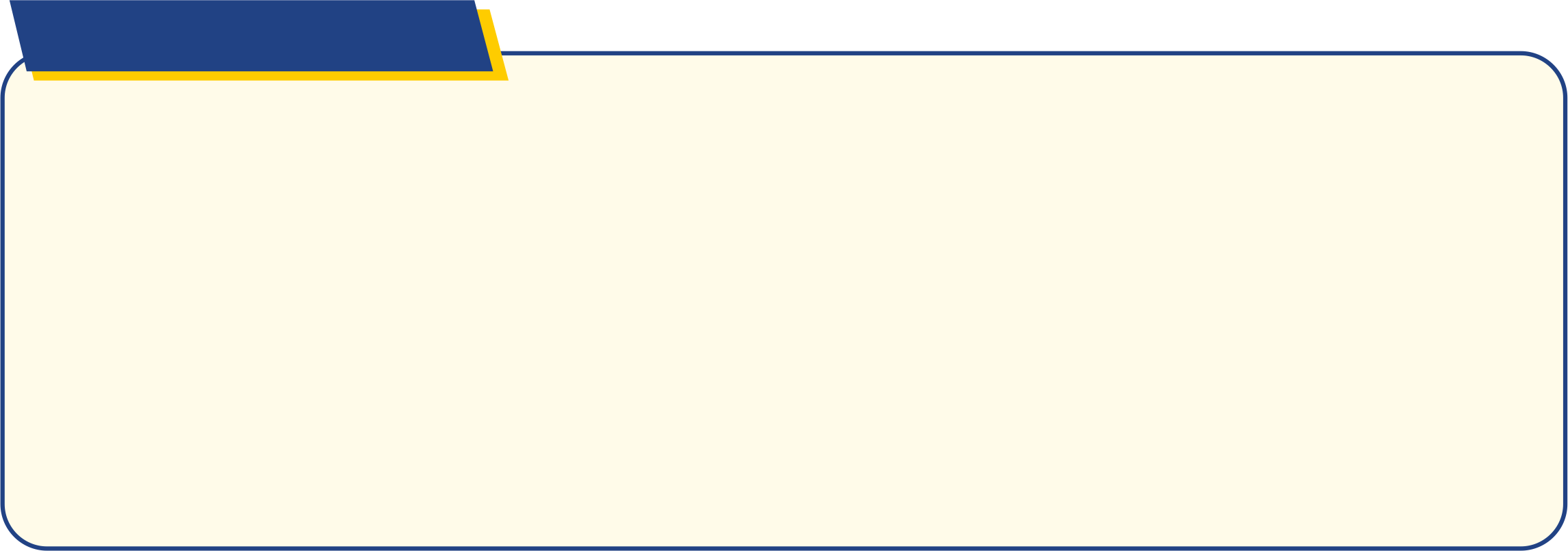

Who Should Invest

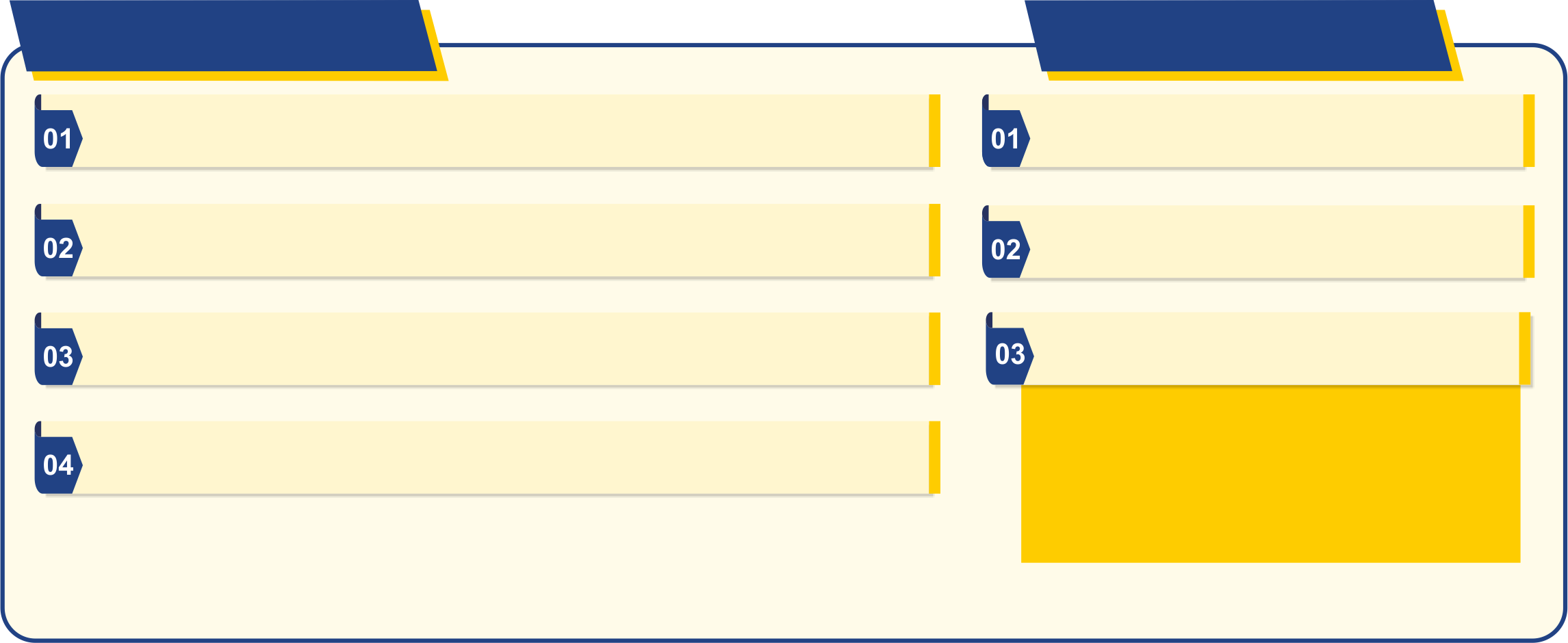

Special Products

Special Facilities

Systematic Investment Plan (including SIP Pause*, SIP Step up Facility, Micro SIP)

Systematic Transfer Plan (Fixed Systematic Transfer Plan and Capital Appreciation STP facility)*

Systematic Withdrawal Plan* (Monthly, Quarterly, Half Yearly and Yearly Option)

Automatic withdrawal of Capital Appreciation*

The Investors will have an option to cancel the SIP, STP/SWP during the ongoing offer period, for details in this regard, please refer Statement of Additional Information.

Note: The SIP start date in case of NFO registration shall be after the Scheme reopening date.

*Available only during New Fund Offer Period. | For further details of above special products / facilities, kindly refer SAI (Statement of Additional Information).

Facility to transfer Dividend (IDCW)

Auto Switch Facility*

Acceptance of Transactions through Online platforms viz.,

- AMC Website – www.licmf.com

- MF Central

- MF Utilities

- Stock Exchanges (NSE/ BSE)

- Registrar and Transfer Agent platforms

Asset Allocation

Under normal circumstances, the asset allocation of the Scheme would be as follows:

| Instruments | Indicative allocations (% of total assets) | |

|---|---|---|

| Minimum | Maximum | |

| Equity and equity related instruments of companies following Consumption theme | 80 | 100 |

| Equity and equity related instruments of other than above companies | 0 | 20 |

| Debt * and Money market instruments | 0 | 20 |

| Units issued by REITs and InvITs | 0 | 10 |

*Debt securities include securitised debt upto 20%. Please refer the Scheme Information Document for detailed asset allocation pattern.

Load Structure

Exit Load -

-

If units are redeemed / switched-out within 90 days from

allotment:

- Upto 12% of the units: No exit load will be levied.

- Above 12% of the units: Exit load of 1% will be levied.

- If units are redeemed / switched-out after 90 days from allotment:No exit load will be levied.

Minimum Application Amount

Lumpsum Application Amount (Other than fresh purchase through SIP) – Rs. 5,000/- and in multiples of Rs.1 thereafter.

SIP* Amount -

- Daily – Rs. 100/- and in multiples of Rs.1/- thereafter.

- Monthly – Rs. 200/- and in multiples of Rs.1/- thereafter

- Quarterly – Rs. 1,000/- and in multiples of Rs.1/- thereafter

*SIP Start date shall be after re-opening date of the scheme

Fund Manager

Mr. Sumit Bhatnagar

Mr. Karan Doshi

Benchmark Index

Nifty India Consumption Total Return Index (TRI)

Plans and Options

Regular Plan is for investors who wish to route their investment through any distributor.

Direct Plan is only for investors who purchase /subscribe Units in a Scheme directly with the Mutual Fund or through Registered Investment Advisor (RIA) and is not available for investors who route their investments through a Distributor

The Regular and Direct plan will be having a common portfolio.

1. Growth Option

2. Income Distribution cum Capital Withdrawal (IDCW) Option*

- Reinvestment of Income Distribution cum Capital Withdrawal Option.

- Payout of Income Distribution cum Capital Withdrawal Option

Default Option/ Sub option - Growth Option - (In case Growth Option or IDCW Option/ Sub option is not indicated)

*Amounts under IDCW option can be distributed out of investors capital (equalization reserve), which is part of sale price that represents realized gains. For detailed disclosure on default plans and options, kindly refer SAI (Statement of Additional Information).

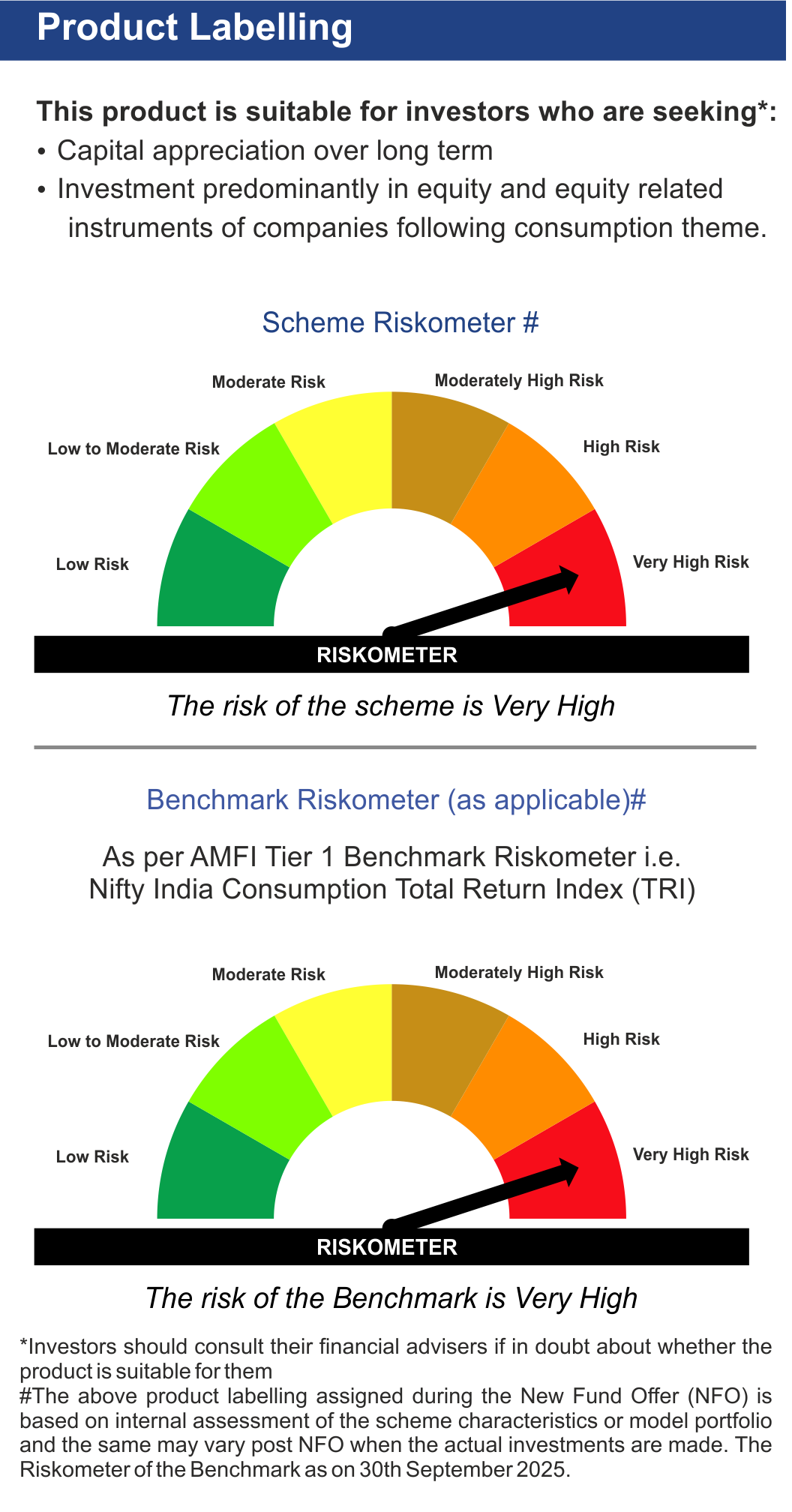

Riskometer

Product Labelling

Scheme Riskometer #

Benchmark Riskometer (as applicable)#

As per AMFI Tier 1 Benchmark Riskometer i.e. Nifty India Consumption Index (TRI) #

This product is suitable for investors who are seeking*:

- Capital appreciation over long term

- Investment predominantly in equity and equity related instruments of companies following consumption theme.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them #The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. The Riskometer of the Benchmark as on 30th September 2025.